Number of companies disclosing their biodiversity-related risks, dependencies and impacts

Last updated: 2025

Latest data available: 2025

Introduction

This indicator summarises the number of companies reporting their biodiversity-related risks, dependencies and impacts. In the UK, there is no single framework to which all applicable companies report and which covers all aspects of this indicator, and reporting is optional. The metadata for this headline indicator proposes using a number of high profile frameworks for reporting risks, dependencies, and impacts of business and biodiversity, and therefore this publication uses data provided by the Taskforce on Nature-related Financial Disclosures (TNFD), with additional data and context from CDP (previously known as the Carbon Disclosure Project) and the World Benchmarking Alliance (WBA). Guidance for this indicator suggests including large companies (those with 300+ employees and / or £15 million in revenue and or £15 million in assets, see Technical Annex); however none of the reporting frameworks used here allow disaggregation in this way.

This indicator and is being published as part of the UK’s response to the Kunming-Montreal Global Biodiversity Framework (GBF), and replaces the previous UKBI on Biodiversity and Business. This indicator relates to GBF Target 15: businesses assess, disclose and reduce biodiversity-related risks and negative impacts.

Data for this indicator can be found in the published datafile.

Type of indicator

Pressure indicator.

Type of official statistics

Official statistic in development. This first iteration of the indicator is reported as part of the UK’s commitment to the Convention on Biological Diversity (CBD) and the Global Biodiversity Framework (GBF). Comments and feedback on the methods chosen are welcome. For more information, please visit the UK Statistics Authority’s website on types of official statistics – UK Statistics Authority.

Assessment of change

As this is the first iteration of this indicator, there are currently insufficient data points available to carry out any assessment of change.

Key results

This indicator reports the number of UK-registered companies which have committed to make disclosures aligned with the Taskforce on Nature-related Financial Disclosures (TNFD) recommendations. These were first reported in the 2024 financial year with a further set of new disclosures in 2025. While it is not possible to specify how many companies meet the exact criteria of this indicator (see Technical Annex), the UK government reports that there are 8,000 companies with more than 250 employees registered in 2023.

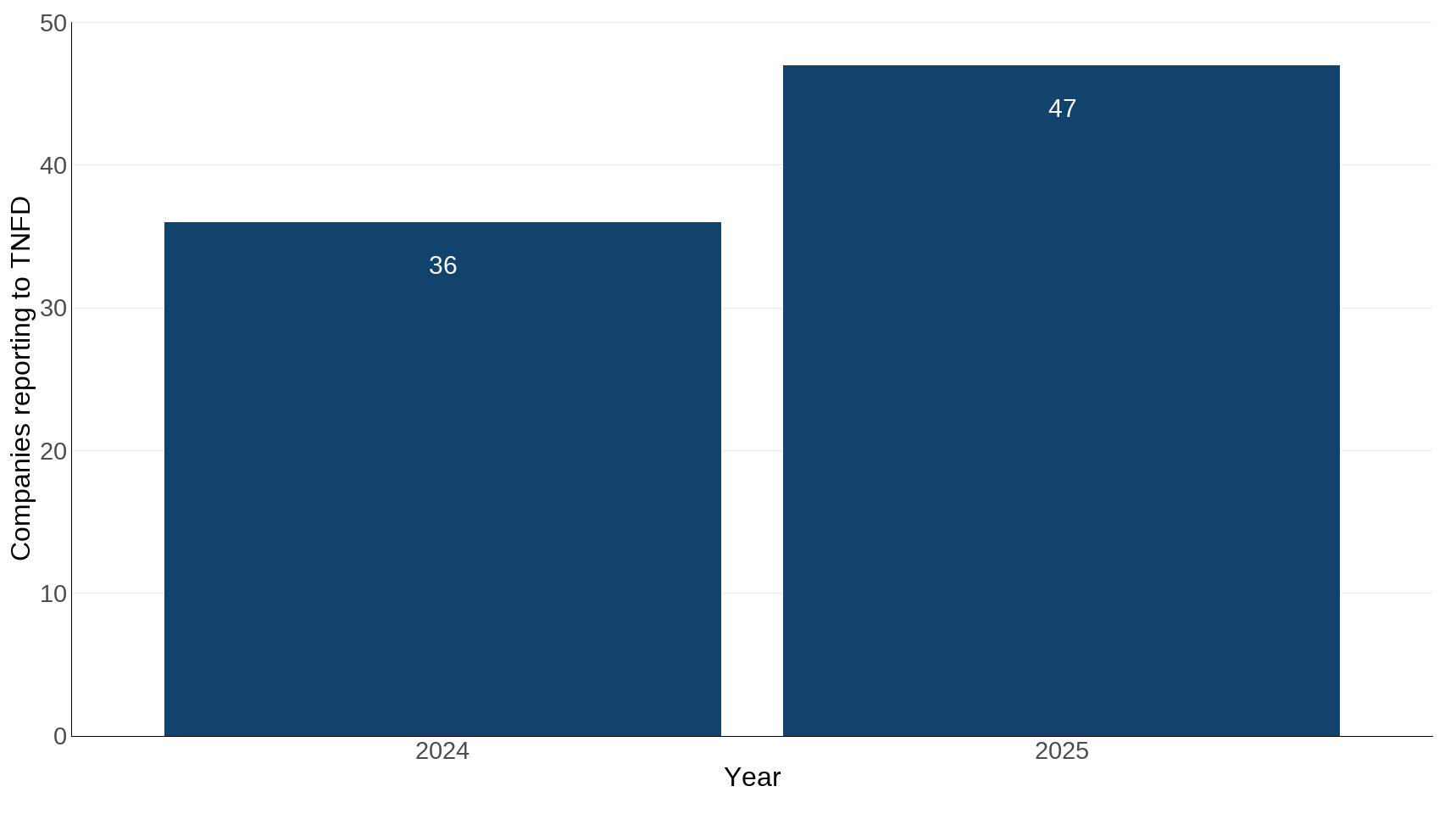

The number of these companies reporting on their biodiversity risks, dependencies, and impacts in line with TNFD recommendations in 2024 and 2025 combined is 83. 47 companies adopted the framework in 2025, increasing from 36 the previous year. It is expected that all 36 adopters in 2024 would also be undertaking TNFD-aligned reporting in 2025.

Figure 1: Companies making their first TNFD-aligned disclosures by year, 2024 to 2025.

Source: TNFD

Notes about Figure 1

- TNFD group companies as adopting the framework in 2024 (or earlier) or in 2025.

- Financial years run from April to March; the 2024 year therefore runs from April 2023 to March 2024.

- These data refer to companies defined as ‘large’ - see Technical Annex.

However, TNFD is only one of several similar frameworks and reporting tools which companies may use to measure their sustainability and biodiversity-related disclosures, and this indicator also presents contextual data from the World Benchmarking Alliance and CDP. The World Benchmarking Alliance (WBA) assesses nature-related impacts, risks and dependencies and within this, measures meaningful progress as well as full alignment to the benchmarks. Of the 34 large UK companies assessed by the WBA, in 2025 14 showed meaningful progress towards the requirements of this indicator, and 11 of these are not TNFD adopters. While this dataset is not publicly available, this is likely to indicate progress, as only one UK company demonstrated credible evidence of progress on this topic in the previous version of the benchmark.

CDP is aligned with and enables compliance with global guidance for reporting and disclosing risks and opportunities in the key areas of biodiversity, climate, forests, plastics and water provided by the Taskforce on Climate-related Financial Disclosures (TCFD).

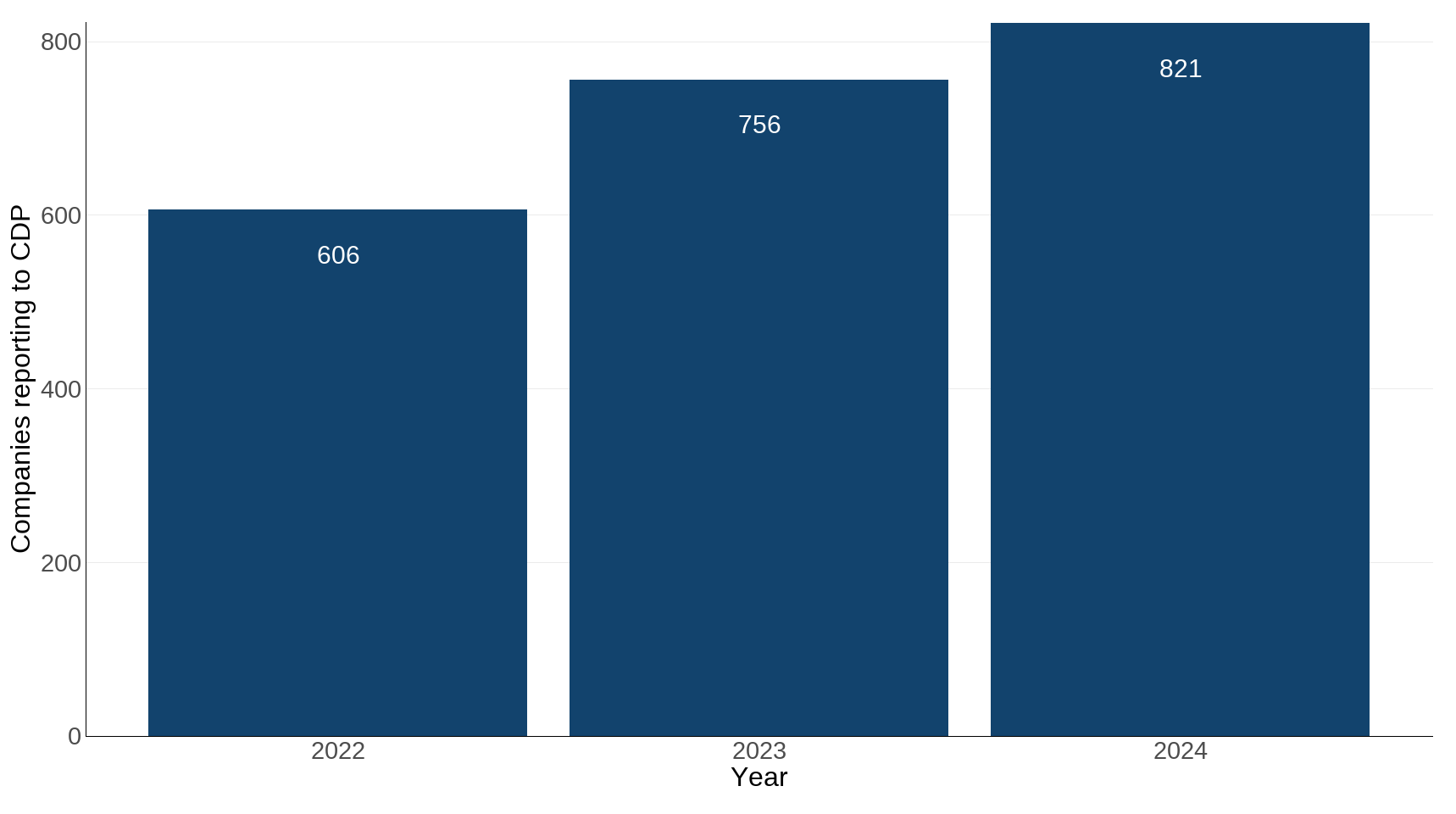

The reporting which companies provide to CDP has a broader scope than TNFD, and TNFD is very new, so adding information from CDP provides more information on the pattern of reporting risks, impacts and disclosures by companies. CDP has 3 years of data on climate disclosures (Figure 2); however, CDP data does not allow a breakdown by company size, and Figure 2 therefore presents all UK companies reporting to CDP on their climate risks and dependencies.

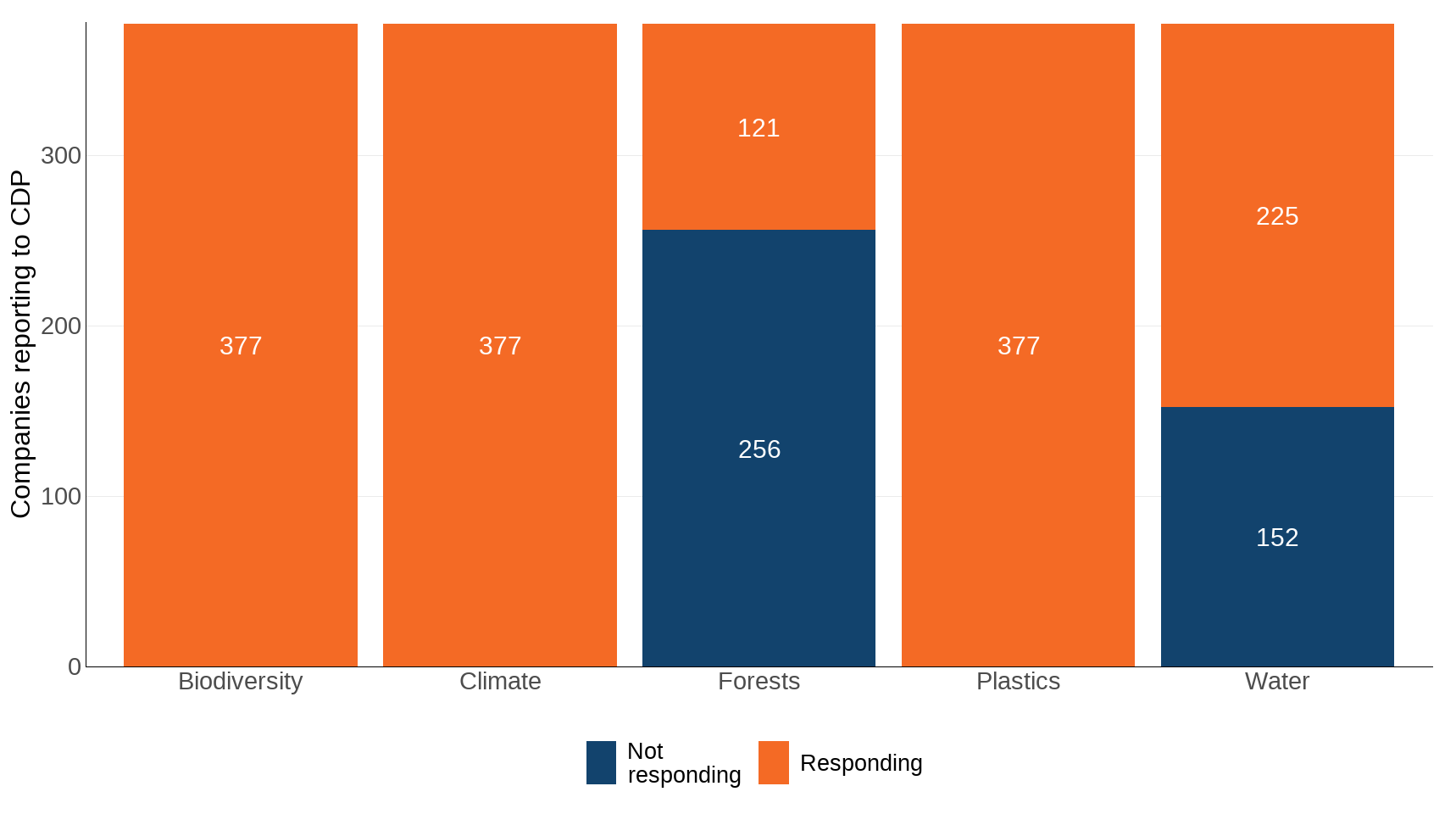

The most recent year of reporting to CDP (2024) has increased granularity which includes disclosures relating to biodiversity, forests, plastics and water (Figure 3), although not all companies reporting to the overall framework also report on these disaggregations.

Figure 2: CDP climate reporters by year, 2022 to 2024

Source: CDP

Figure 3: Large companies reporting to CDP responding on biodiversity, climate, forests, plastics and water, 2024

Source: CDP

Notes about Figure 3

- In total, 377 large companies (see Technical Annex) reported to CDP on biodiversity, climate and plastics in 2024.

- Not all of these companies responded on forests and water.

Further detail

The included companies reporting to TNFD (2025) and CDP (2024) come from a range of sectors (Tables 1 and 2).

Table 1: Companies reporting to TNFD by sector, 2025

| Business type | Companies reporting |

|---|---|

| Corporate - Listed | 34 |

| Financial Institution or Services | 28 |

| Market Service Provider | 8 |

| Government Agency or Department | 5 |

| Other | 4 |

| Data Provider | 2 |

| Academic or Scientific Institution | 1 |

| Development Bank or Multilateral Finance Institution | 1 |

Source: TNFD

Table 2: Companies reporting to CDP by sector, 2024

| Company type | Number reporting |

|---|---|

| Services | 178 |

| Infrastructure | 39 |

| Manufacturing | 37 |

| Retail | 32 |

| Food, beverage & agriculture | 21 |

| Materials | 20 |

| Transportation services | 15 |

| Biotech, health care & pharma | 12 |

| Hospitality | 9 |

| Fossil fuels | 7 |

| Apparel | 6 |

| Power generation | 1 |

Source: CDP

Relevance

Reporting on biodiversity-related risks, dependencies and impacts allows companies to understand their negative and positive contributions to local and global nature and biodiversity. However, there is no single framework in the UK for collating data on these practices, and this indicator aims to address that information gap. Additionally, these data will allow government to understand the connections between biodiversity, business, and finance, and to target regulations that address the most pressing challenges while also promoting sustainability.

International/domestic reporting

The suite of UK Biodiversity Indicators has been revised and updated to bring it in line with the Global Biodiversity Framework (GBF) of the Convention on Biological Diversity (CBD). Some UKBIs will be used for the forthcoming UK national reports to CBD. This is the headline indicator for Target 15, businesses assess, disclose and reduce biodiversity-related risks and negative impacts.

Web links for further information

Acknowledgements

Thank you to the many people who have contributed by providing data, and to the many colleagues who have helped produce this indicator.

Technical annex

Methodology

The headline values presented here are a total of the companies reporting to TNFD and CDP, and have been generated by aggregating unique company names in the focal years. As recommended by the CBD, the focus is on large companies – defined as those with 300+ employees and / or £15 million in revenue or £15 million in assets; however not all reporting frameworks include these disaggregations in their data.

The recommendations of the TNFD are designed to align with those of the Global Biodiversity Framework, with conceptual foundations for nature-related disclosures built around the four pillars of: governance, strategy, risk and impact, and metrics and targets. These are consistent with the International Financial Reporting Standards from the International Sustainability Standards Board (ISSB).

CDP is partially aligned with TNFD, and aims to become fully aligned in future to support global reporting. The questionnaire used by CDP responders contains a large bank of questions designed to enable companies to start to align with the requirements of TNFD and other frameworks.

Caveats and limitations

There is no single framework to which all applicable companies report, and reporting to the frameworks which do exist is optional. The headline value for the indicator is the number of companies reporting to the TNFD, but this indicator also presents data from CDP, in order to provide increased context to the headline value. Due to the differing nature of the two frameworks, it is not possible to combine the data into a single headline value.

Development plan

This is a new indicator. In future, we plan to continue to report using data from TNFD, and add context from CDP and other relevant frameworks while also investigating new sources of data. We are keen to hear from our users about these intended changes, as well as our published development plan; please email us.

Categories:

Published: